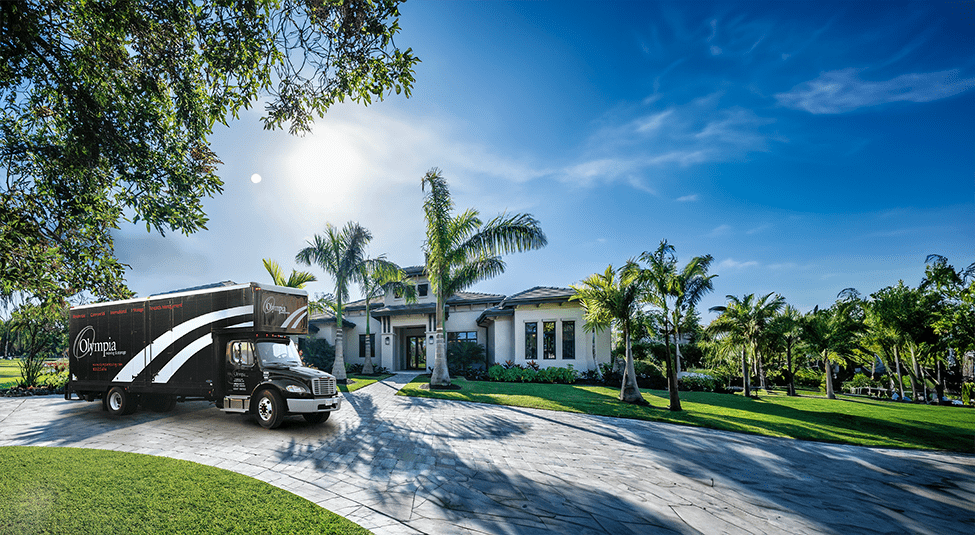

Move Planning Center

Resources and Moving Tips

-

Purchase Moving Boxes & Supplies

Buy moving boxes and supplies from Olympia—we’ll deliver them to your door.Order Moving Supplies -

Frequently Asked Questions

Our FAQ page will help you answer a variety of questions related to the entire moving process.FAQ’s -

Download Free Label Templates

Pack better with Olympia’s room-by-room labels—download, print, and use!Box Labels -

Client Move Portal

Log into your Olympia Move Portal to keep track of important documents and track the progress of your move.Client Login

Video Tutorials

Packing can seem intimidating. Fortunately, our comprehensive “How to Pack” video series is here to guide you! Learn the best ways to pack dishes, china, tools, breakable items, and more.

Customer Rights & Responsibilities

As our customer, you have specific rights and responsibilities, and we’re committed to ensuring you understand each aspect of the moving process. Choosing an established, insured, and professional moving company matters, and we’re here to make you feel informed and comfortable every step of the way.

Posts Listing with Category Filters and Pagination

-

A.J. Schneider • 12 Jun 2025

A.J. Schneider • 12 Jun 2025Olympia Moving & Storage Recognized as Wheaton’s Agent of the Month for the 12th Time

-

AJ Schneider • 10 Jun 2025

AJ Schneider • 10 Jun 2025Moving Services for Seniors in Tampa: Compassionate Care for Life Transitions